World’s 7 Biggest financial Scams that burnt Investor’s money.

A financial scam is the modernized era’s new famine for the masses. The way financial fraud disseminates an individual’s assets and liquidity is a concern for the world at large. It is critical to analyse how the term financial scam is a picture in the mind of investors.

A financial scam is a dishonest plan intended to trick people or organizations into parting with cash or precious assets by providing incorrect information or making promises of great returns with little to no risk. Scams can affect their victims financially significantly and come in a variety of shapes, including Ponzi schemes, investment fraud, phishing attacks, and insider trading. To prevent being a victim of a financial scam, it is critical to exercise caution and conduct in-depth research on any investment offer before committing funds.

The financial scan also impacts the trust factor that is embodied in a financial system and institutional values get harmed. When the trust factor starts to fade away people do not just lose money but even the intent to invest in one economy. They are the factors that massacre the soul of investing hearts. The investigative institution always has to keep pace with the financial scams that happen around and catch at the time of the conspiracy otherwise the system shall go havoc.

The world has experienced several eyes widening scams and even question the moral condition of a human beings. In the subject matter of today, we have to be prepared for future upcoming scams that are in making to happen. But it is important to save our hard-earned money that is the reason it is important to take learning from the past. To get a proper learning tangent on the subject matter learning about the biggest fraud in the financial market shall be beneficial for hoi polloi.

Harshad Mehta Scam of 1992

The scam is the elephant in the room not in the angle of the total money that was transacted but the scam was a staggering one in the stock market of India. The perspective it had given to the masses was one of delusion and made people think twice before stepping up their financial boots.

The Harshad Mehta scandal of 1992 was among India’s largest stock market frauds. Stockbroker Harshad Mehta used banking system vulnerabilities to fund his stock market speculation while manipulating the Indian stock market. He manipulated demand by artificially inflating stock prices, making enormous sums of money through illicit ways.

This finally resulted in a market bubble that burst, sending the stock market plummeting sharply and sparking widespread panic. The swindle, which cost an estimated several billion dollars, undermined trust in the Indian stock market. After the scandal, the Securities and Exchange Board of India was created to control and monitor the Indian securities market.

The trust deficit in the market remained for a while but as it is said the market is supreme to any individual. And when a person thinks he is above the forces of the market the force hits the individual or such institution back in a hard manner.

The Enron Scandal of 2001

The Enron Scandal was a business scandal involving the American energy corporation Enron Corporation that surfaced in 2001. It was discovered that the corporation had inflated its reported financial results and concealed its indebtedness by using dishonest accounting techniques.

This trick misleads stakeholders and investors, artificially driving up the stock price of the company. Once the fraud was discovered, the business filed for bankruptcy in December 2001, making it one of the biggest corporate failures in American history.

Several executives were found guilty of securities fraud as a result of the crisis, which also significantly altered American laws and corporate governance procedures. The Enron Scandal was a turning point in the history of corporate responsibility and openness, and it continues to serve as a lesson for both companies and investors.

The cycle of such crimes is established as the commission of such offence and regulators making a new rule to regulate it. Unfortunately, the cycle always continues as the wrongdoers are many times ahead of the regulating bodies.

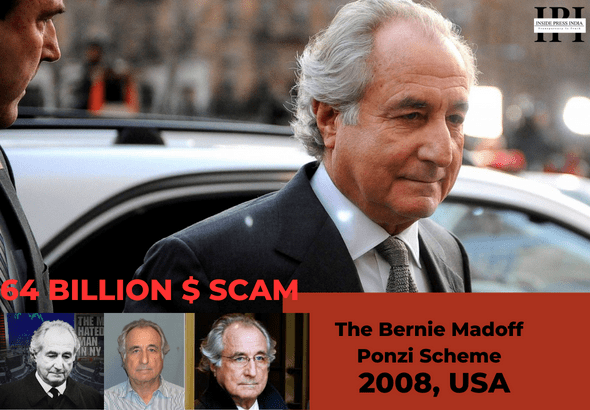

The Bernie Madoff Ponzi Scheme

Bernie Madoff, a former stockbroker and investment counsellor, was the mastermind behind the enormous financial scam known as the Bernie Madoff Ponzi Scheme. As part of the plan, Madoff persuaded clients to invest their money with him by guaranteeing them large returns with little risk. Madoff created the appearance of a profitable investment by using the money from new investors to make returns to existing clients rather than investing the funds as promised.

This is a sign of a Ponzi scheme, which got its name from Charles Ponzi, who employed a similar strategy in the 1920s.

In December 2008, the Bernie Madoff Ponzi Scheme was uncovered, and it was later determined to be one of the biggest financial scams ever. Madoff was detained and later given a 150-year prison term. Thousands of individual and institutional investors suffered enormous financial losses as a result of the scheme, many of whom lost their whole life savings.

The Bernie Madoff Ponzi Scheme continues to serve as a lesson on the perils of high-yield investment schemes and the significance of conducting thorough research before making a financial market investment.

WorldCom Accounting Scandal

A significant business fraud involving WorldCom, one of the biggest telecommunications corporations in the United States at the time, occurred in the early 2000s. To artificially exaggerate WorldCom’s earnings and deceive investors and authorities, the financial records of the company were altered as part of the scandal.

After the scam was uncovered in 2002, it was determined that WorldCom had exaggerated its profitability over many years by billions of dollars by using dishonest accounting techniques, such as classifying regular expenses as investments and recording fictitious entries in its accounting records. The controversy contributed to the demise of WorldCom, which ultimately filed for bankruptcy as a result of which investors and employees suffered enormous financial losses.

One of the biggest corporate frauds in history, the WorldCom Accounting Scandal led to criminal charges being brought against senior WorldCom executives, including the CEO, Bernard Ebbers. The scandal also prompted tighter oversight of business accounting procedures and the implementation of new rules to enhance financial reporting and transparency.

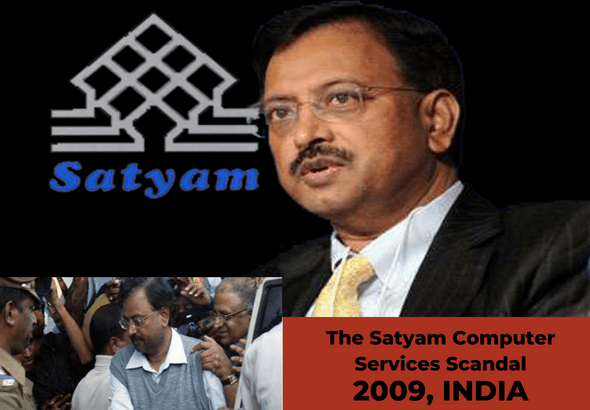

The Satyam Computer Services Scandal of 2009

The Satyam computer services scandal had a direct impact on many individuals as the investment portfolio of several individuals had a critical share in its rise. One of the biggest providers of information technology (IT) services in India, Satyam Computer Services, was implicated in the Satyam Computer Services Scandal, a financial scam that surfaced in 2009.

The business’s chairman and founder were engaged in the scandal and were accused of abusing corporate cash, fabricating financial statements, and deceiving regulators and investors.

When the fraud was uncovered in 2009, it was later determined that the chairman had artificially inflated the company’s reported earnings by using several accounting techniques, including the production of fraudulent invoices and overstating the company’s revenue and profits. As a result, Satyam’s stock price dropped, investors suffered large losses, and the public lost faith in the business.

The Satyam Computer Services Scandal served as a reminder of the significance of corporate governance and responsibility in preserving the integrity of the financial markets and led to criminal charges and a lengthy prison sentence for the involved chairman.

The scandal also resulted in stronger investor protections and increased governmental scrutiny of company accounting methods. The Satyam Computer Services Scandal serves as a sobering reminder of the risks of financial fraud and the value of doing your research before making a financial market investment.

The Parmalat Scandal of 2003

One of the biggest dairy and food corporations in Italy, Parmalat, was involved in the Parmalat Scandal, a financial scam that occurred in 2003. Senior officials, including the founder and CEO, were implicated in the scandal and accused of abusing corporate cash, fabricating financial documents, and deceiving authorities and investors.

The management had concealed the company’s true financial situation and artificially inflated its reported earnings using a variety of accounting techniques, it was later disclosed after the scam was uncovered in 2003. Due to this, the share price of Parmalat plummeted, investors suffered substantial losses, and investors lost faith in the business.

One of the biggest corporate scams in European history, the Parmalat Scandal led to criminal indictments and lengthy prison terms for the executives involved. The scandal also resulted in stronger investor protections and increased governmental scrutiny of company accounting methods. The Parmalat Scandal serves as a sobering reminder of the risks of financial fraud and the value of doing due diligence while making investments in the stock market.

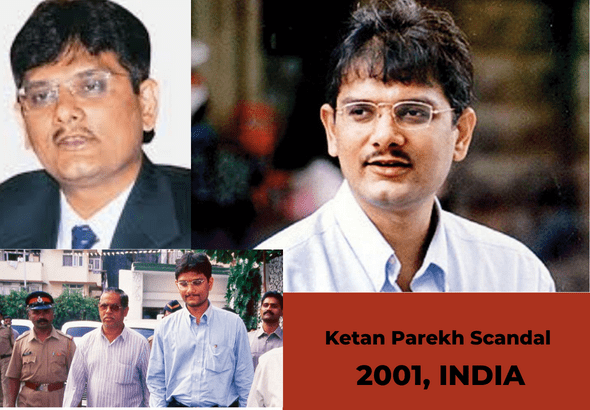

Ketan Parekh Scandal

The Ketan Parekh fraud, which involved stockbroker Ketan Parekh and various banks and financial organisations, occurred in India in the early 2000s. Through a network of fictitious businesses and dubious activities, Parekh manipulated the stock market, producing artificially inflated stock values and huge losses for both investors and the financial institutions involved.

When the scheme was discovered in 2001, Parekh was eventually taken into custody and accused of financial crimes and securities fraud. The case is still a noteworthy illustration of market manipulation and financial wrongdoing in India.

Although the precise amount of the Ketan Parekh scam’s losses remain unknown to the general public, it is assumed to be in the range of several billion rupees. Many investors, as well as the banks and financial institutions involved in Parekh’s fraudulent transactions, suffered large financial losses as a result of the scam. The scandal had a significant impact and contributed to a general decline in confidence in the Indian stock market. Despite this, the market finally bounced back and has since kept expanding and developing.

Writer’s view

Financial frauds and scandals have always been a critical tangent for evolving a capital market. The factor of trust deficit is a derivative that continuously affects the investors and their funds. The need is not to just regulate financial markets and statements of the company, the wrongdoers are always ahead in the system than the masses.

The need is to give education to the hoi polloi so that they do not get misguided and not get into such traps. It is a symbol of modernized development, the capital market has a lot of potential but the retail investor has to be assured.

The assurance would be a boosting force and shall allow the markets to grow continuously. Investors should follow an established mantra that every stock has a company and a responsible investor must find what the company does. So tighten your seat belts of knowledge and be ready for the roller coaster ride of the financial markets.

Click here to read more about- World’s biggest financial scandals.

(Written By – Devya Shah)

Join IPI membership and get exclusive benefits for free- JOIN NOW

Subscribe INSIDE PRESS INDIA for more

Subscribe To Our Newsletter

World’s 7 World’s 7 biggest financial scamsWorld’s 7 biggest financial scamsWorld’s 7 biggest financial scamsWorld’s 7 biggest financial scam

sWorld’s 7 biggest financial scamsWorld’s 7 biggest financial scamsWorld’s 7 biggest financial scamsWorld’s 7 biggest financial scamsWorld’s 7 biggest financial scamsWorld’s 7 biggest financial scamsWorld’s 7 biggest financial scamsWorld’s 7 biggest financial scamsWorld’s 7 biggest financial scamsWorld’s 7 biggest financial scamsWorld’s 7 b

ggest financial scamsWorld’s 7 biggest financial scamsWorld’s 7 biggest financial scamsWorld’s 7 biggest financial scamsBiggest Scandals World’s 7 Biggest Scandals World’s 7 Biggest Scandals World’s 7 Biggest Scandals World’s 7 Biggest Scandals World’s 7 Biggest Scandals World’s 7 Biggest Scandals World’s 7 Biggest Scandals World’s 7 Biggest Scandals World’s 7 Biggest Scandals World’s 7 Biggest Scandals World’s 7 Biggest Scandals World’s 7 Biggest Scandals World’s 7 Biggest Scandals World’s 7 Biggest Scandals World’s 7 Biggest Scandals World’s 7 Biggest Scandals

[…] World’s 7 biggest financial scams that burnt Investor’s money till its teeth, CLICK HERE […]

[…] World’s 7 biggest financial scams that burnt Investor’s money till its teeth, CLICK HERE […]

[…] World’s 7 biggest financial scams that burnt Investor’s money till its teeth, CLICK HERE […]